You are here

National Debt

In response to Obama's weekly statement last week, Sen. Judd Gregg (R-NH) said the following:

“In the next five years, President Obama’s budget will double the national debt; in the next ten years it will triple the national debt.

“To say this another way, if you take all the debt of our country run up by all of our presidents from George Washington through George W. Bush, the total debt over all those 200-plus years since we started as a nation, it is President Obama’s plan to double that debt in just the first five years that he is in office.

“He is also planning to spend more on the government as a percentage of our economy than at any time since World War II.

I don't blame Gregg for being concerned about debt. We simply can't continue to grow the debt forever. That's common sense, but let's keep Obama's budget proposal and Gregg's sensationalist response in historical perspective. Let's take a look the history of our debt. The national debt is currently about $11 trillion.

Largest % of GDP since WWII? Well, conventional wisdom says that we're also in the midst of the worst recession/depression since the Great Depression that immediately preceded WWII. Conventional wisdom also says that it was deficit spending in response to the Great Depression and WWII that got our economy back on track. Though we should be concerned about the debt, Keynesian economics says now isn't the time to cut spending. Here's a plot from zFacts.com that illustrates the debt as a percentage of GDP:

Gregg is also quite concerned that in 5 years Obama will double the 200-plus years of debt since we started our nation. Well, that 5-year to 200-year comparison is silly. For many of those 200 years, the size of our economy was nothing like it is now...they simply aren't comparable.

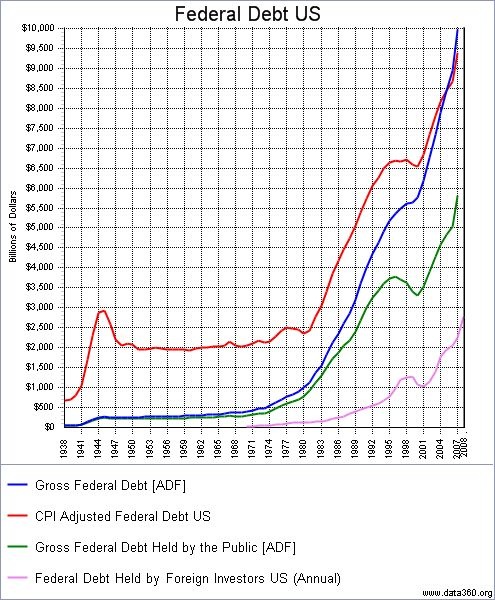

From Data360, here is a plot of debt history in absolute terms.

The blue line is what Gregg is talking about in his 200-plus-year concept. However, take a look at the value when Reagan took office ($1 trillion). Then follow the line to the present day. That little plateau and slight reduction were during the Clinton years. During the 20 years that Reagan, Bush, and Bush were in office, the debt grew from $1 trillion to $11 trillion, a factor of 11. Compare that to the debt growth that is freaking out Gregg: doubling in 5 years (equivalent to 2x2x2x2 = 16 over 20 years) and tripling in 10 years (equivalent to 3x3 = 9 over 20 years). That is, Obama plans the debt to grow by a factor comparable to what happened under Reagan and the two Bush presidents.

Reagan had his tax cuts and immense military build-up. His peace-time debt growth was unprecedented. Bush had his tax cuts and war in Iraq. Obama has his economic stimulus, healthcare reform, and addressing climate change. Regardless of how you look at the debt (in terms of % GDP or in absolute terms), it seems to me that Obama's budget plans are more or less a continuation of the addiction to debt pioneered by Reagan, Bush, and Bush. It's no secret that fiscal conservatives aren't too happy with the debts racked up by George W. Bush, but I don't get the impression that the feel the same about Reagan. I'm pretty sure that the debt accumulation by neither Reagan nor Bush elicited the doomsday projections that Obama's is prompting. Does Obama Derangement Syndrome deserve any of the blame.

Theme by Danetsoft and Danang Probo Sayekti inspired by Maksimer