You are here

Sacrifice is for the little people

Regarding the controversy about whether to extend the "Bush-era tax cuts" to nobody, people making less than $250,000, or everyone...

From last Sunday's Krugman op-ed (h/t: rtoddbouldin):

“Taxes are what we pay for civilized society,” said Oliver Wendell Holmes — but that was a long time ago...Never mind the $700 billion price tag for extending the high-end tax breaks: virtually all Republicans and some Democrats are rushing to the aid of the oppressed affluent...

It’s partly a matter of campaign contributions, but it’s also a matter of social pressure, since politicians spend a lot of time hanging out with the wealthy. So when the rich face the prospect of paying an extra 3 or 4 percent of their income in taxes, politicians feel their pain — feel it much more acutely, it’s clear, than they feel the pain of families who are losing their jobs, their houses, and their hopes. And when the tax fight is over, one way or another, you can be sure that the people currently defending the incomes of the elite will go back to demanding cuts in Social Security and aid to the unemployed. America must make hard choices, they’ll say; we all have to be willing to make sacrifices.

But when they say “we,” they mean “you.” Sacrifice is for the little people.

Of course, a similar argument could be aimed at the Obama admin's policies that, after the economic collapse, have made whole and protected the wealth of Wall St. while doing relatively little to relieve the suffering on main street.

Did you know this (link)?

Obama's "tax cuts for the middle class" aren't actually tax cuts for the middle class. They're tax cuts on all family income up to $250,000. So if you make $300,000 a year, you're getting a tax cut on $250,000. That's a serious tax cut! That's why the graphs showing how different taxpayers make out under the Obama and Bush tax plans all show a tax cut for the rich under Obama's plan:

Those who would pay higher taxes under Obama's plan typically aren't excited about that prospect, and one law professor famously complained that he didn't welcome paying higher taxes in order to finance "...the vast expansion of government [Obama] is planning." Ezra Klein pointed out the reality (link):

Henderson's taxes aren't financing the government Obama would like to build. They're financing the government America already has. George W. Bush passed his tax cuts without offering any offsetting spending cuts. It was apparent then, and is even more apparent now, that he'd brought federal revenue beneath the level of federal spending -- and then he increased spending, too. Nothing Obama has signed into law will add as much to the deficit as Medicare Part D, for instance. Or the two wars George W. Bush began. Or, for that matter, the tax cuts Bush passed...The basic story here is that Henderson got a tax cut that the government could never actually afford, and it still can't. That situation predated Obama and has nothing to do with his agenda.

The effect that the proposed changes would have on small businesses (and what exactly is a "small business") is also a subject of controversy:

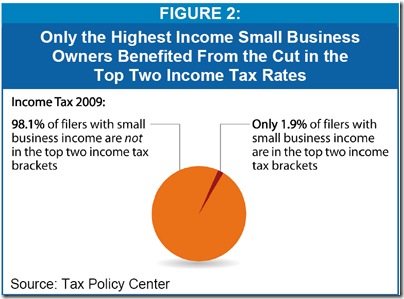

According to President Obama and the Democrats, 97 percent of small businesses will see their tax rates remain the same. Republican counter that the remaining three percent of small businesses -- about 750,000 of them -- constitute half of all small-business income. There's only one way both of those statements can be true: Many of those 750,000 small businesses aren't small at all. Some, like Bechtel Corporation, are positively enormous.

The Democratic and Republican figures come from the non-partisan Joint Committee on Taxation. But numerous think tanks and government organizations have examined the data and come to similar conclusions: First, that letting the Bush tax cuts on the top two brackets of "small-business" income would impact a tiny percentage of those businesses; and second, that many of the "small businesses" that would be impacted are actually giant companies -- which explains why such a tiny fraction of them can account for half of small business income.

According to the Washington Post, which obtained its information from House Democrats, some of the "small businesses" that could see a small increase in their marginal taxes are household names like accounting giant PricewaterhouseCoopers and Tribune Corp. -- privately-owned behemoths whose owners and managers dodge corporate taxes by reporting profits on their income tax returns.

And did you know this? If all of the tax cuts were allowed to expire, we'd be tantalizingly close to balancing the budget by 2015:

Today, the economy is sluggish and the national debt is soaring to worrisome levels. As lawmakers bicker over whether to extend the Bush-era tax cuts, not just for the middle class but also for the wealthy, many economists and budget analysts say there's a simple way to curb borrowing: Let the tax cuts expire for everyone.

Official and independent budget estimates show that letting tax rates spring back to pre-Bush levels for all taxpayers would bring the country within striking distance of meeting President Obama's goal of balancing the budget, excluding interest payments on the debt, by 2015...

But for all the election-year hand-wringing about deficits, no one in Washington is talking about letting the tax cuts lapse on schedule in January. Instead, Senate Republicans have offered a measure that would extend all the cuts, adding nearly $4 trillion to the debt over the next decade. This week, Senate Democrats say they plan to unveil a bill that would preserve most of the cuts for most Americans. That would add nearly $2 trillion to deficits by 2020.

I get the point that the current struggling economy may be a bad time to raise taxes, but I don't get how conservatives can keep a straight face while lamenting the growing debt out of one side of their mouth and out of the other accepting no responsibility to propose serious spending cuts sufficient to pay for their proposed tax cuts.

Theme by Danetsoft and Danang Probo Sayekti inspired by Maksimer